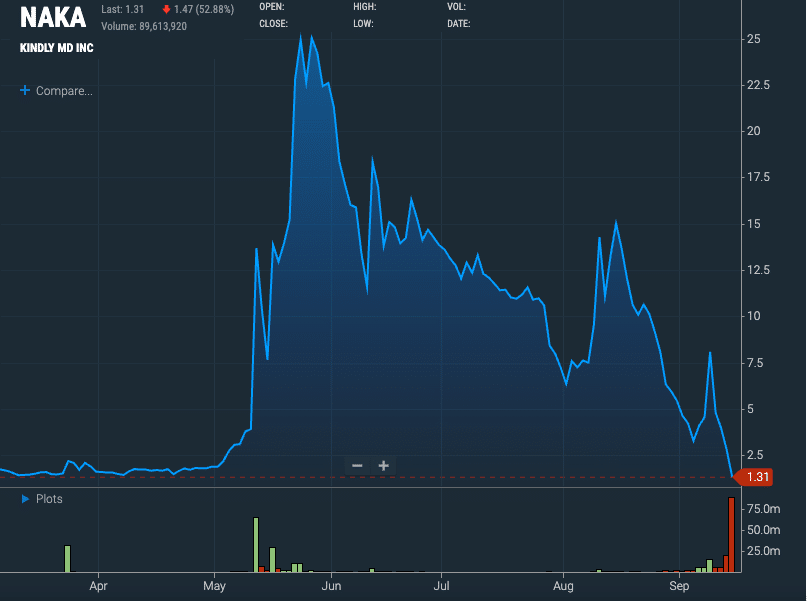

Ah, the theater of finance! Behold the tragicomic spectacle of Nakamoto (NAKA), a company that soared like a balloon only to pop with a resounding *splat*! David Bailey, its intrepid CEO, emerged from his week-long slumber to proclaim on the digital stage of X, “The only way out is through. We’ll get this over with as quickly as possible.” 🌪️ One cannot help but marvel at the audacity of such a statement, as if the 96% stock crash were but a minor hiccup in the grand ballet of Bitcoin treasuries! Oh, the folly of it all!

“The only way out is through. We’ll get this over with as quickly as possible. What’s critical is building an aligned shareholder base.”

– David Bailey🇵🇷 $1.0mm/btc is the floor (@DavidFBailey) September 15, 2025

From its triumphant public debut on May 12, when the stock danced at a giddy $34.77, to its humiliating plunge to $1.16 by September 15, NAKA’s journey is a farce worthy of Gogol’s pen. A 60% drop over a single weekend? Preposterous! Yet, there was Bailey, undeterred, declaring, “Despite the last two weeks being brutal for NAKA stock they’ve also been our most productive.” 🧐 Productivity in chaos-a true artist of spin!

The Carnival of Selling Pressure

What caused this calamity, you ask? Ah, the usual suspects: private placement financing, early investors snatching shares at a pittance ($1.12, no less!), and retail investors left holding the bag at $28.51. Jameson Lopp, Adam Back, and their ilk feasted like crows on the carcass of public enthusiasm. Bailey, ever the optimist, dubbed this debacle “upgrading our shareholder base.” 🧹 Out with the weak-handed, in with the true believers! Or so he hopes.

Names that stood out to me:

Jameson Lopp: 1,340,000 shares of $NAKA

Balaji Srinivasan: 273,038 shares of $NAKA

David Bailey: 11,160,572 shares of $NAKA

Clark Moody: 100,000 shares of $NAKA

Adam Back: 8,928,572 shares of $NAKA

Danny Yang: 450,000 shares of $NAKA

Jeff Park: 89,286…– Pledditor (@Pledditor) September 15, 2025

Bailey, ever the wordsmith, urged his flock to “brave the storm,” even as the cost to borrow NAKA shares soared to a ludicrous 2000%. “The highest in the nation!” he crowed, as if this were a badge of honor rather than a neon sign flashing *DOOM*. 🌩️ From “I can feel the stampede building” to “To the ₿ullievers go the spoils,” his rhetoric has taken a nosedive as steep as his stock price.

“Wow. Intense volume. Thankful for all the messages of support. Today is a day of transition. We are upgrading our shareholder base from short term traders to long term investors. Brave the storm.

To the ₿ullievers go the spoils.”

– David Bailey🇵🇷 $1.0mm/btc is the floor (@DavidFBailey) September 15, 2025

The Moral of the Farce

And so, dear reader, we are left with a cautionary tale of greed, hubris, and the perils of Bitcoin-backed dreams. NAKA’s rise and fall is a mirror to the crypto sector’s volatility, a reminder that hype is but a fleeting breeze. Will Bailey’s narrative gymnastics save the day, or will NAKA join the graveyard of forgotten crashes? Only time-and the fickle gods of the market-will tell. 🕰️🤡

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- USD THB PREDICTION

- Brent Oil Forecast

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Doge Doomed?! 😱🐳

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

2025-09-16 02:30