🎭 Ah, mon ami! After months of joyous inflows, the US spot Ethereum ETF market is now experiencing a tragic exodus, with capital fleeing for the fourth consecutive trading day. 🏃♂️💨

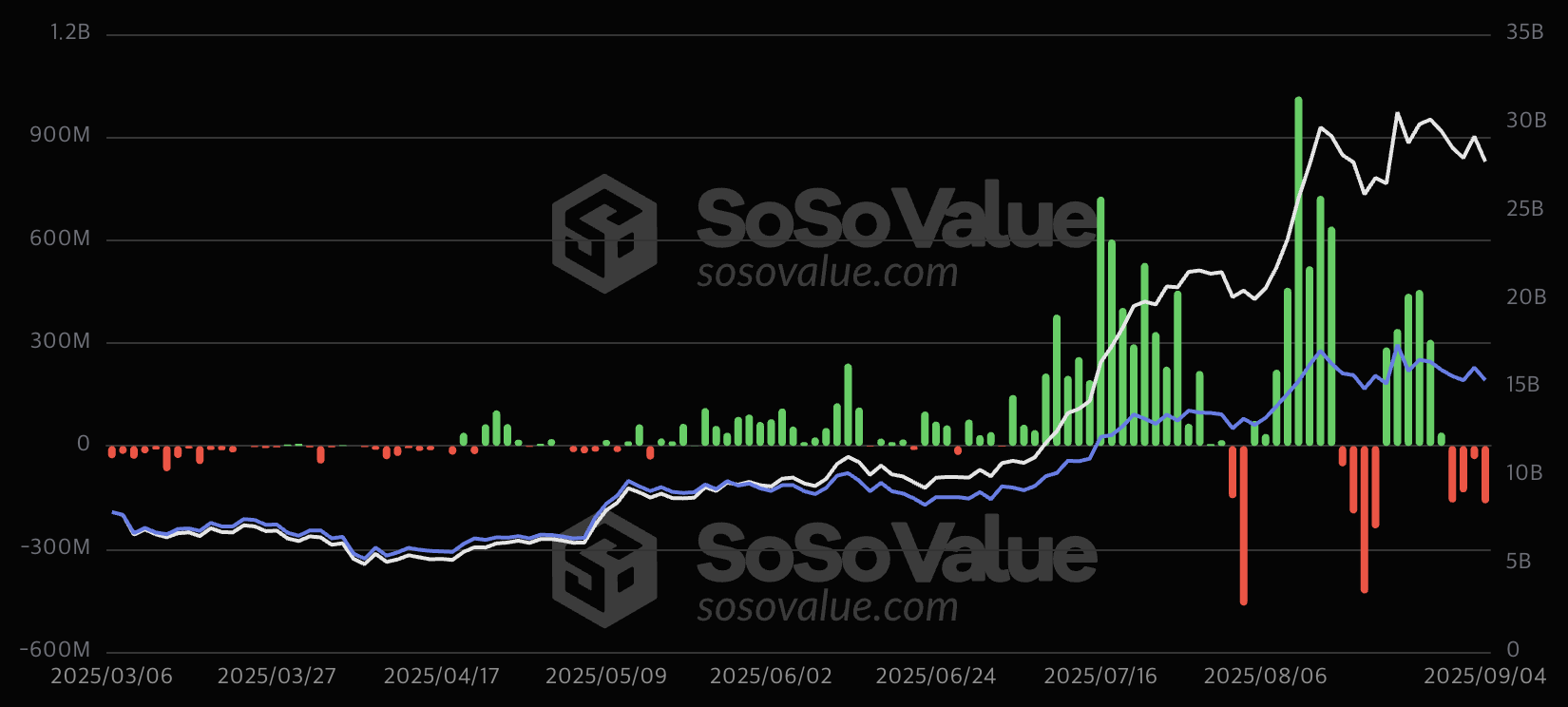

According to the esteemed on-chain data service platform Soso Value, the US spot Ethereum ETF market saw a net outflow of $167.41 million on Thursday, causing the price of ETH to close at a modest $4,275. 📉

🎭 ETHA: The Lone Survivor in a Sea of Outflows 🌊

🍿 The primary culprit behind these outflows was Fidelity’s FETH, which witnessed a dramatic $216.68 million exit. Bitwise’s ETHW also recorded a significant net outflow of $45.66 million. Yet, amidst the chaos, BlackRock’s ETHA stood tall, enjoying a net inflow of $148.8 million. 🛡️

🎭 This marks the fourth consecutive day of outflows for the Ethereum spot ETF market. The trend began on August 29 with a net outflow of $164.64 million, followed by $135.37 million on September 2, and $38.24 million on September 3. 📅

🎭 DAT Companies: The Unsung Heroes 🦸♂️

💼 For the past five months, a surge in capital from spot ETFs and aggressive buying by Digital Asset Treasury (DAT) companies acted as two key engines, driving Ethereum’s price up by more than 2.5 times its previous low. 🚀

🛒 While ETF flows have reversed, DAT companies show no signs of slowing down. Bitmine, the public company with the most extensive ETH holdings, purchased 78,000 ETH on August 28 and another 74,300 on Tuesday. SharpLink Gaming bought 39,000 ETH on the same day, while The Ether Machine accumulated 150,000 ETH on Tuesday. 🤑

🎭 Despite the continued buying from institutional players, the recent four-day outflow from spot ETFs has coincided with a 1.4% drop in the ETH price. This suggests that the ETF outflows weigh heavily on short-term investor sentiment, creating a stalemate in a price that has otherwise seen a strong rally for months. ⚖️

👀 All eyes are now on Friday’s US Non-Farm Payroll (NFP) report. Should the NFP figures fall below expectations, it could revive hopes that the Federal Reserve will embark on consecutive interest rate cuts. The market is now waiting to see if this macroeconomic signal can reverse the outflow trend and reignite the Ethereum spot ETF market. 🔄

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- USD HUF PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Bitcoin Investors Are Making Bank and Changing Their Minds. What’s Going on? 🤔

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

2025-09-05 13:32